About Us!

Since 2001, Akhuwat has been working for Poverty Alleviation

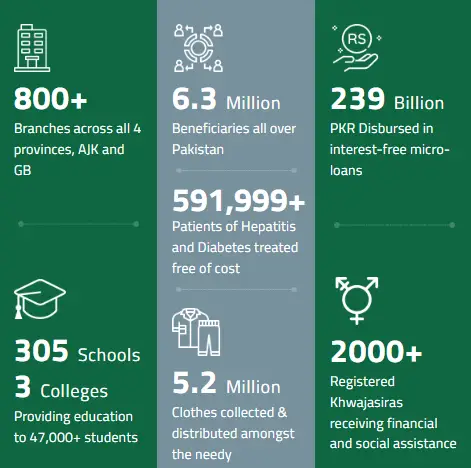

Akhuwat, a not-for-profit organization founded in 2001, is built on the Islamic principle of Mawakhat (solidarity). Inspired by the generosity of the Ansars in 622 CE—who shared their wealth with the Muhajirs fleeing persecution—Akhuwat envisions a world without inequality. By fostering a spirit of compassion, where the fortunate uplift those in need, we create lasting change. Join us in this mission and be a part of transforming lives!

Projects and Programs

AKHUWAT ISLAMIC MICROFINANCE

Useful Links

- Board Of Director

- Branch Network

- Akhuwat Progress Report

- Impact Assessment Reports

- Loan Process

- Loan Products Offered

- Testimonials

Akhuwat interest Free loan - اخوت فاؤنڈیشن بلاسود قرض

اخوت فاؤنڈیشن کے ساتھ اخوت لون 2025 آسان ہے! چاہے آپ کو گھر، کاروبار، تعلیم یا شادی کے لیے قرض کی ضرورت ہو، ہم مدد کے لیے حاضر ہیں۔ ہم یقینی بنائیں گے کہ قرض کا عمل آپ کے لیے آسان اور ہموار ہے۔ ہماری ٹیم ہمیشہ آپ کی مدد کے لیے تیار ہے تاکہ آپ بغیر کسی مسئلے کے اپنا قرض حاصل کر سکیں۔ ہم اس بات کو یقینی بنانا چاہتے ہیں کہ قرض آپ تک محفوظ طریقے سے پہنچ جائے۔

Akhuwat Foundation’s new loan for 2025 has started, and you can right away! This plan follows Islamic principles, and people from all over daily. If you’re unsure how to use it, just reach out to our Akhuwat WhatsApp support team—they’re here to guide you step-by-step!

Get an Akhuwat Loan: Easy, Interest-Free Support for You

Akhuwat Loan is here to help people by giving interest-free loans to those who need money to start a business, buy a car, or support their family. We want to make life easier for those who don’t have a lot of money, helping them grow and reach their dreams.

Why Pick Akhuwat Loan?

At Akhuwat Loan, you can borrow money without any extra fees or charges. Our mission is to support small business owners, students, and families in getting the funds they need to succeed.

Types of Akhuwat Loans

- Business Loans: Start or expand your small business.

- Education Loans: Get money for school or college.

- Health Loans: Help with medical expenses or emergencies.

- Family Loans: Support for important family needs.

- Housing Loans: Build, fix, or improve your home.

- Agriculture Loans: Help farmers buy seeds, tools, or animals.

- Marriage Loans: Support for wedding expenses.

Akhuwat Loan: Interest-Free Support for a Better Life

The Akhuwat Foundation Loan Scheme is a program that gives interest-free loans to those in need across Pakistan, helping them grow their businesses and improve their lives. With simple and fair terms, Akhuwat makes it easier for people who are struggling financially to get the help they need to achieve their goals.

People have used these loans to successfully run their own businesses. But Akhuwat loans aren’t just for business—you can also get loans for school, health, housing, or even building a new home. Akhuwat believes in unity and equality, making sure everyone has a chance to succeed.

Welcome to the Akhuwat Foundation 2025

In 2025, Akhuwat Foundation will continue offering interest-free loans from PKR 50,000 to PKR 5,000,000. These loans help people start or grow businesses, pay for education, manage household expenses, or cover wedding costs.

Inspired by Islamic values and the concept of mawakhat (brotherhood), Akhuwat aims to support those in need and promote financial independence.

Since 2004, Akhuwat has empowered thousands across Pakistan by providing a unique, interest-free lending model. More than just loans, Akhuwat focuses on kindness, community support, and helping people break free from poverty.

Easily Check Your Akhuwat Loan Status Online

Dear valued customers, Akhuwat now offers the convenience of applying for your loan online! To review your loan status, just enter your valid CNIC and the official file number provided by the Akhuwat Loan Department. If you experience any issues with the online loan status check, please reach out to our Akhuwat WhatsApp Helpline for assistance. We’re here to help!

How to Check Your Akhuwat Loan Status Online?

If you have taken a loan from Akhuwat, there’s now an easy way to track your payments! Akhuwat Foundation recently added a feature on their official website that lets you check how many installments you’ve paid and how much you still owe.

To view your loan status, simply enter your ID card number and file number or mobile number on the website. This self-checking system was created to help customers easily monitor their loans.

Visit the Akhuwat Foundation’s official website anytime to stay updated on your loan details. We hope this helpful feature makes managing your loan easier!

Check Akhuwat Loan Status Online Here

یہاں سے اپنے اخوت قرض کی درخواست کی حیثیت آن لائن چیک کریں۔

🔍 Search Loan by CNIC

Akhuwat Loan Scheme Plan 2025

| Loan Amount (PKR) | Time Period | Monthly Installment (EMI) |

|---|---|---|

| 50,000 | 1 Year | 4,170 |

| 100,000 | 1 Year | 8,335 |

| 500,000 | 5 Years | 8,335 |

| 1,000,000 | 10 Years | 8,335 |

| 1,500,000 | 10 Years | 12,500 |

| 2,000,000 | 10 Years | 16,670 |

| 3,000,000 | 10 Years | 25,000 |

| 5,000,000 | 15 Years | 27,780 |

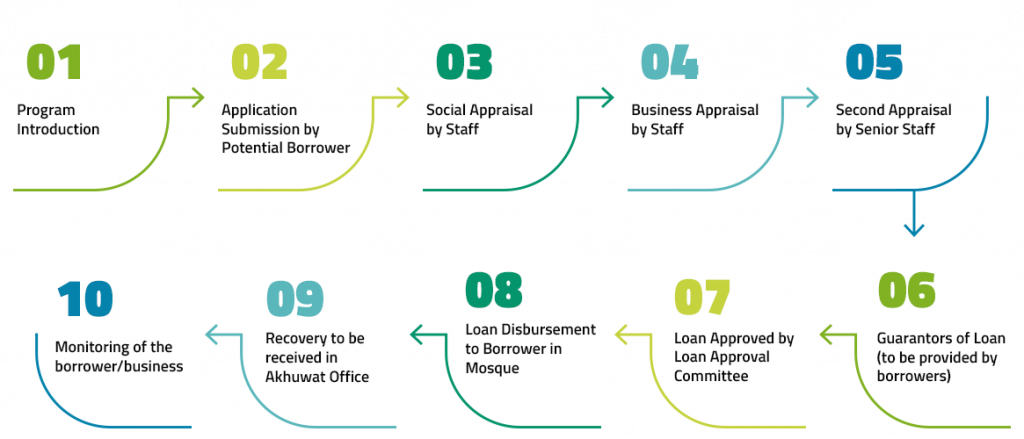

Akhuwat Loan Apply Process- Step by Step Guide

Eligibility Criteria for Loans

Following general points are compulsory for eligibility of loan:

- Applicant must have a valid CNIC (Computerized National Identity Card).

- Must be between 18 to 62 years of age and capable of initiating or running a business.

- Applicant should be economically active.

- Should not be convicted of any criminal offense or involved in any ongoing legal proceedings.

- Must have a good social and moral reputation within the community.

- Should have the capacity to provide two guarantors (other than family members).

- Must be a resident within the operational area of the branch office (usually within a 2–2.5 KM radius).

Note: – Project specific eligibility criteria may be varied.

Lending Methodology – Akhuwat AIM

- Two Types of Lending Methods:

- Group Lending

- Individual Lending

- The lending method depends on the loan product and project requirements.

1- Group Lending

- Designed for groups of 3 to 6 individuals (men or women) looking to enhance family income.

- All members guarantee each other’s loan and credentials.

- Group members should live near each other and not be close relatives.

- Promotes mutual understanding, social cohesion, and collective problem-solving.

- Helps resolve economic and social issues through group support.

2- Individual Lending

- Targeted at individuals who meet the loan eligibility criteria.

- Applicant must provide two guarantors (non-family members).

- Helps individuals meet their financial needs through interest-free loans (Qard-e-Hasan).

Akhuwat Loan Application Submission Process

1- Application Submission

- Step 1: Visit the nearest AIM branch with relevant documents.

- Step 2: Initial discussion with Unit Manager to verify eligibility.

- Step 3: Submit the loan application on prescribed form (filled by AIM staff).

- Step 4: Documents are checked and processed for further evaluation.

2- Loan Collateral Requirements

- Personal responsibility

- Two guarantors

- Postdated cheques

- Additional collateral (if required by scheme)

Required Documents For Akhuwat Loan

3- Required Documents

CNIC Copies:

- Applicant (Mandatory)

- Guarantors (Mandatory)

- Family Member (Optional)

Latest Utility Bill:

- For address verification and payment behavior assessment

Latest Passport-Sized Photos:

- For identification purposes

Nikahnama Copy (Marriage Certificate):

- Mandatory (May be waived after verification)

- Helps verify spousal identity if CNIC differs

📌 Note: Additional documents may be requested based on the scheme.

4- Social Appraisal Process

- Conducted by Unit Manager through:

- Information from existing borrowers

- Observation of applicant’s lifestyle

- Feedback from neighbors

- Personal/family interviews

💼 Business Appraisal

- Evaluates business plan viability and income potential.

- Assesses whether income can cover household expenses and loan repayment.

- Family interview ensures support and awareness of the business plan.

🔁 Second Appraisal by Branch Manager

- Reviews social and business appraisals.

- Meeting held with applicant and guarantors for final evaluation.

🏦 Fund Request & Approval

Once approved by the Loan Approval Committee (LAC):

- Fund request is sent to Head Office via Regional Manager.

- Head Office processes and transfers the funds.

💸 Loan Disbursement

- Disbursement takes place monthly, usually at a mosque or church event.

- Group Lending: All members must be present.

- Individual Lending: Applicant must be accompanied by at least one guarantor.

- Funds are transferred via:

- Cash Over Counter (COC) facility at designated bank

- Direct Bank Transfer (depending on loan type and project)

- Alternative verifiable methods at AIM’s discretion

Apply for Akhuwat Loan – A Simple Step Toward a Better Future

Managing your Akhuwat loan is easy with the user-friendly online loan check system. Follow these simple steps to check your loan details and stay updated on your repayment status:

Visit the Official Website

Navigate to the Akhuwat Foundation’s official website and click on the “Apply Now” button to access the loan services section.Access the Loan Check System

Locate the Loan Status Check System available on the website’s dashboard or application page.Enter Required Information

Provide your CNIC number (ID card) and registered mobile number to proceed.Click “Check Loan”

Select the “Check Loan” option to view your detailed loan information.View Your Loan Details

Instantly see your personalized loan summary, including:- Total Loan Amount

- Number of Installments Paid

- Remaining Balance

- Time Left for Loan Completion

- Borrower’s Name and Profile Information

💡 Note: Akhuwat’s online loan tracking system is designed for simplicity and ease of use, helping you stay informed and manage your finances efficiently.

Akhuwat Foundation 2024-25 Loan Program Empowering Everyone with Interest-Free Loans

The Akhuwat Foundation continues its mission to provide interest-free financial support through its updated loan schemes for 2024-25. This program is designed to assist individuals from all income levels—whether you need startup capital, support for education, or help with household expenses.

With a simple and accessible application process, applicants can now avail loans up to PKR 5,000,000 without extensive documentation or collateral.

Quick & Easy Loans – Up to PKR 5 Lakh Disbursed Within One Day!

In a significant update, Akhuwat Foundation now offers loans up to PKR 5 lakh in just one day, helping individuals meet urgent needs without delays.

- 💰 Loan Amounts: Up to PKR 500,000

- ⏱ Processing Time: Same-day approval and disbursement

- 📉 Installments: Starting from as low as PKR 3,400 per month

- 📍 Nationwide Access: Apply from anywhere in Pakistan

- 🙌 Open to All: For men and women aged 18 years and above

Akhuwat Foundation Online Loan Application – Apply in 2025

Applying for a loan through Akhuwat is now more convenient than ever. You can apply online or visit your nearest branch. Here’s how:

How to Apply for Akhuwat Loan: Step-by-Step Guide

- Visit the Official Website – Go to the Akhuwat Foundation’s website.

- Select Your Loan Type – Choose from business, education, or emergency loans.

- Fill Out the Application Form – Provide basic personal and business details.

- Attach Required Documents:

- Valid CNIC

- Proof of income

- Business profile (if applicable)

- Submit Your Application – Submit it online or at your nearest branch.

- Receive Your Loan – Once approved, loans are disbursed quickly—often within hours.

Loan Amounts & Repayment Flexibility

- Loan Range: PKR 50,000 to PKR 5,000,000

- Tenure Options: 1 year to 20 years

- Interest Rate: 0% interest (Qarz-e-Hasna)

- Collateral: Not required for most loans

Note: You can also choose fixed or flexible installment plans to suit your financial situation.

📞 Contact Akhuwat Foundation – We’re Here to Help!

- 🏢Head Office Location: Lahore, Pakistan

- 📱Phone/WhatsApp Support: [Insert Official Number Here]

- 📧Email & Online Assistance: Available on the official website

- 🌐Website: [Insert Official Website URL]

⚠️ Stay Safe – Beware of Fake Loan Scams on Social Media

- Due to the foundation’s popularity, scammers are spreading fake ads and loan offers on Facebook and other platforms.

- Akhuwat NEVER charges advance fees.

- Do not share your personal information with unauthorized sources.

- Always verify through the official website or helpline.

- Report any suspicious activity immediately to the Akhuwat support team.